Close menu

- Home

- Telcos

- Network & IT

- Infra

- People

- Finance & Strategy

- Events

- Regions

- Thought Leadership

- Premium

- TelcoX EMEA Leadership & Performance Study

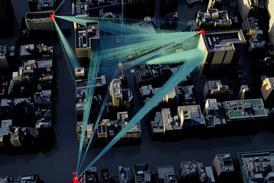

EE spins up spectrum to further 5G ambitions

Joe Purnell2021-04-27T12:18:00

Joe Purnell2021-04-27T12:18:00

Source: EE

New licences put to use minutes after being issued, in partnership with Nokia. BT pays an additional £23m after initial low-ball auction, but Group still bagged “an excellent price”, says Consumer CEO Marc Allera. EE open to future spectrum trades as O2 and Vodafone sign their own deal.

Register for free to continue reading this article

Already registered? Sign in here.

Join the TelcoTitans community and continue reading this article

By registering for a free account, you will get immediate access to the rest of this article, plus:

- Enhanced access to TelcoTitans with three free article views per month

- TelcoTitans Daily and Weekly newsletter briefings

“The detail is very good. Better than we get internally.” – GM, Vodafone OpCo

Want full access to TelcoTitans content? Check out our subscription options.