- EE leads world with adoption of Ericsson inter-site 5G SA aggregation, claiming improved reliability and enhanced speeds.

- Operator’s standalone rollout continues to advance beyond 50% population coverage, the largest reach of any UK MNO.

- VodafoneThree ready to mount improved challenge to EE strength if/when promised network investment materialises.

- UK remains a European laggard, with continental peers putting local operators’ progress in context.

EE has launched Advanced RAN Coordination (ARC) technology on its distributed network, working with Ericsson to improve 5G service reliability and produce noticeably faster speeds.

EE is the first operator “globally” to roll out the inter-site 5G downlink carrier aggregation technology on its live mobile network. The deployment enables neighbouring mobile sites to share capacity, ostensibly spreading the load. It claims to improve downlink data speeds by an average of 20% and up to 50% in “ideal conditions”.

Following trials in Bristol, the ARC solution is now live in some areas of Edinburgh and Manchester ahead of a rollout in Belfast, Cardiff, Glasgow, Leeds, Liverpool, London, Newcastle, Sheffield, and Sunderland over the next year.

Deployment is being focused, at least initially, in areas that experience high traffic. EE has described it as a “software-driven approach” that enables it to contain costs by mitigating the need for additional physical infrastructure in areas where demand is greatest.

Greg McCall, Chief Network Officer at BT Group, called it a “major milestone”.

“ We’re delivering a smarter, faster network that meets the growing demand for data — without the need for disruptive infrastructure changes. ”

McCall.

EE leads the way in the UK…

The ARC go-live came alongside EE’s latest 5G network rollout update, including an announcement of the next major population centres due for a 5G standalone (SA) upgrade.

The operator has plans to extend its 5G SA network to 17 further towns and cities by the end of the calendar year, en route to making 5G SA available to 41 million people by spring 2026. As of early September, EE claimed to cover 34 million of the UK population, a little behind the 35 million end-of-August target set at the start of summer. An interim target of 37 million people by the end of 2025 has also been pencilled in.

EE’s 5G SA network is now over a year old, with the operator joining the party more than a year after rival Vodafone UK launched its only standalone offering. EE, however, has boasted the largest network by population coverage for the past several months.

The newly-consolidated VodafoneThree intends to knock the operator off its perch. It is backed by a supposed £11bn of investment over the next decade and with a combined mobile customer base of 29 million — more than double that of EE. Integration of the Vodafone and Three networks is an ongoing process, but the operators’ merger provides an opportunity to present a real challenge to EE.

Vodafone UK, pre-merger, was the first to launch a commercial 5G SA network in June 2023. Virgin Media O2 followed in early-2024, and EE joined in September. Pre-combination Three UK did not have a 5G SA network, but VodafoneThree has committed to building a self-styled “leading” standalone network as one of its foremost priorities.

By coverage, EE is narrowly winning the race, based on latest available data. It now covers around half the UK’s population, up from 43% (~28 million) in March. As of June, VodafoneThree’s 5G SA network covered 47% (~32 million).

The injection of capital anticipated at VodafoneThree, however, means it is likely to overtake EE in the coming months or years. In announcing the merger’s completion in June, Chief Executive Max Taylor unveiled plans to hit 90% 5G SA population coverage within the first three years of operation (by 2028). This will be driven by front-loaded investment in network upgrades, building towards 99.95% coverage by 2034.

Third operator Virgin Media O2 also presents some competition in the 5G SA race, but has not laid out a specific roadmap for the technology. Its wider 5G network (including non-standalone/NSA) currently covers 75% of the UK population. In 2024, it claimed its rollout plans “align” with the ambitions set out in the UK government’s Wireless Infrastructure Strategy: “standalone 5G to all populated areas by 2030”.

Vodafone Group defines ‘population coverage’ as any outdoor location that records a mere 1Mbps downlink on the network. EE and VM O2 have not specified their own definitions.

EE’s 5G NSA network covered 85% of the UK population and 47% of landmass as of March 2025, with the operator “on track” to hit a 90% population target by 2027, a year ahead of earlier projections. VodafoneThree expects to reach 71% 5G (NSA and SA) by the end of year one (June 2026).

While coverage is important, customers are where the revenue comes from, and VodafoneThree is setting the pace.

EE’s total postpaid customer base has been stable at just shy of 14 million for a year. VodafoneThree, by contrast, was boosted by the merger to reach 21 million at the end of June. VM O2 sits at 15.6 million postpaid mobile customers.

EE is the only UK MNO to regularly report on its 5G customer base. It claimed 10.8 million 5G-enabled customers (those with a compatible device and tariff, covered by the NSA or SA network) at the end of March, up 12% in the year — notably growing faster than the 10% increase to EE’s 5G network population coverage, as customers upgrade to compatible devices. It does not offer data, however, on the amount of time spent actually using a 5G network.

… but European peers make the UK look shabby

Although 5G rollout is seemingly advancing, with the entrance of VodafoneThree and its investment likely to spark some enhanced competition, the UK’s 5G landscape is made to look immature when compared to European neighbours.

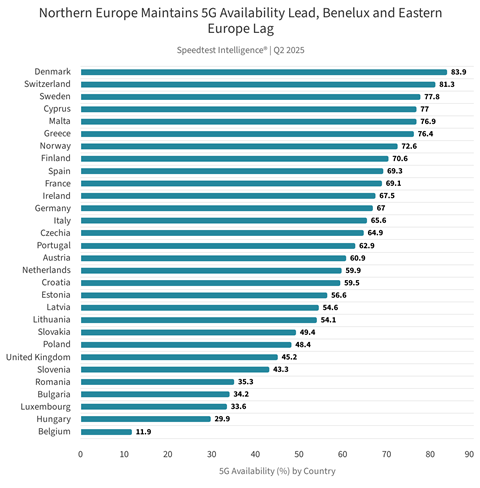

Latest analysis from Ookla, using data to the end of June 2025 (Q2 2025), puts the UK near the bottom of European 5G availability rankings, at around 45% geographic coverage. Northern European states lead the pack, while Benelux, Eastern Europe, and the UK bring up the rear.

Ookla considers regulation in the UK to be among the obstacles to faster deployment. Although rural connectivity and vendor diversity concerns are not unique to the UK, it cited the Telecoms Security Act (to mitigate risk presented by designated ‘high risk vendors’ such as Huawei) and efforts to improve rural 4G networks (via projects like the Shared Rural Network) as examples of initiatives that have distracted UK MNOs from more fulsome 5G/5G SA investment.

On the other hand, it considers the UK government’s Wireless Infrastructure Strategy to be among the more ambitious plans in Europe. If achieved, the strategy’s target to reach 100% 5G SA coverage by the end of the decade would push the UK towards the top of the European rankings, based on what is known of deployment plans across the rest of the region.

The art of marketing technology

The latest announcements around ARC technology and 5G SA rollout plans reflect a change in marketing of the standalone network when compared to the NSA variant launched in 2019.

Speaking in September last year, then-BT Consumer Chief Executive Marc Allera said the marketing is “the tricky bit” of a 5G rollout, with lessons to be learnt from earlier NSA failings. It came with a concession that, as an industry, “we didn’t do the best job of launching 5G”. “We set an expectation that wasn’t met in the early days”, he said.

EE bills the standalone network as its “most advanced” and “most reliable” technology, with markedly less emphasis on the improved speed. It is also emphasising the end-user experience, with Allera having kicked the campaign off with talk of “bringing those experiences and products and services and user needs to life”. He heralded the initial launch as “the first big step forward” for a network designed to keep pace with evolving devices and services that use it: “AI aware, security aware, gaming aware, streaming aware”.

His successor Claire Gillies has followed a similar script since taking over at BT Consumer in April, highlighting end-user experience. “Our customers want the best connection — whether they’re at home or on the move”, she said in June. “That’s why we continue to innovate and invest in our network, ensuring it evolves with their needs”.

Networks chief McCall said EE is focused on upgrading high-traffic areas initially, but is evidently progressing to other parts of towns and cities.

“ Delivering a high-quality mobile experience every day for millions of people is what matters to us, it’s what has driven us to build the UK’s most reliable network and why we’re now delivering 5G standalone to more people in more places across the UK. ”

McCall.