TPG: Vodafone up for £360m windfall as Oz outpost splashes the cash

Following the multi-billion-dollar sale of its fixed assets, TPG Telecom is initiating a major capital return. The “novel and complex” AUD 3bn plan is designed to reward major shareholders while courting minority investors and improving the telco’s stock exchange and credit profile. It also boasted a cracking H1…

This article includes:

- Themes: Capital reduction; Capital return; Cash capex; Credit profile; Credit rating; Customer acquisition; Dividend; EBITDA; Enterprise, Government and Wholesale (EGW); Equity ownership; Financial results; Free float liquidity; Growth; Investment; Minority shareholders; Mobile-led business; Reinvestment plan; Shareholder windfall; Strategic investors.

- Events: Capital return programme; H1 FY25 results; Regional network infrastructure-sharing agreement; Vocus asset sale.

- People: Iñaki Berroeta.

- Geographic: Asia-Pacific; Australia.

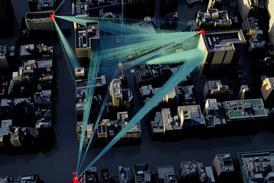

- Organisations: AST SpaceMobile; ASX200; CK Hutchison; Optus; TPG Telecom; Vocus; Vodafone Group; Vodafone Spain; Zegona.

Register for free to continue reading this article

Join the TelcoTitans community and continue reading this article

By registering for a free account, you will get immediate access to the rest of this article, plus:

- Enhanced access to TelcoTitans with three free article views per month

- TelcoTitans Daily and Weekly newsletter briefings

“The detail is very good. Better than we get internally.” – GM, Vodafone OpCo

Want full access to TelcoTitans content? Check out our subscription options.